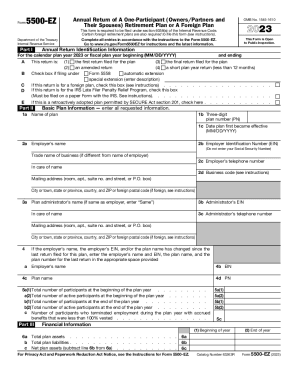

IRS 5500-EZ 2024-2026 free printable template

Instructions and Help about IRS 5500-EZ

How to edit IRS 5500-EZ

How to fill out IRS 5500-EZ

Latest updates to IRS 5500-EZ

All You Need to Know About IRS 5500-EZ

What is IRS 5500-EZ?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 5500-EZ

What should I do if I realize I've made an error on my IRS 5500-EZ after submission?

If you discover an error after submitting your IRS 5500-EZ, you can amend your filing by completing a new form reflecting the corrections. Be sure to indicate that the form is an amendment, and submit it according to IRS guidelines. It's essential to keep records of both the original and amended forms for your documentation.

How can I track the status of my IRS 5500-EZ submission?

To verify the status of your IRS 5500-EZ submission, you can use the IRS online tools or contact their support for assistance. If you e-filed, keep an eye out for any confirmation emails indicating your submission was received. In case of rejection, you will typically receive a notification detailing the reasons.

Are there specific e-signature requirements for filing the IRS 5500-EZ?

When filing the IRS 5500-EZ electronically, ensure that your e-signature meets IRS standards. It's crucial that your signature is applied in a manner acceptable to the IRS, as improper signatures may lead to processing delays or additional inquiries.

What steps should I take if I receive a notice from the IRS regarding my 5500-EZ forms?

Upon receiving a notice from the IRS about your IRS 5500-EZ filing, promptly review the content of the notice and provide the requested information or documentation. It's advisable to respond within the specified time frame to avoid further penalties and ensure your compliance.

See what our users say